Hello.

I think this post will be an important one.

In Korea, if students start school on March 1st, office workers like us in Malaysia have to do something like the year-end tax settlement that they did a year ago called E-Filing.

So I'd like to tell you about E-Filing this time.

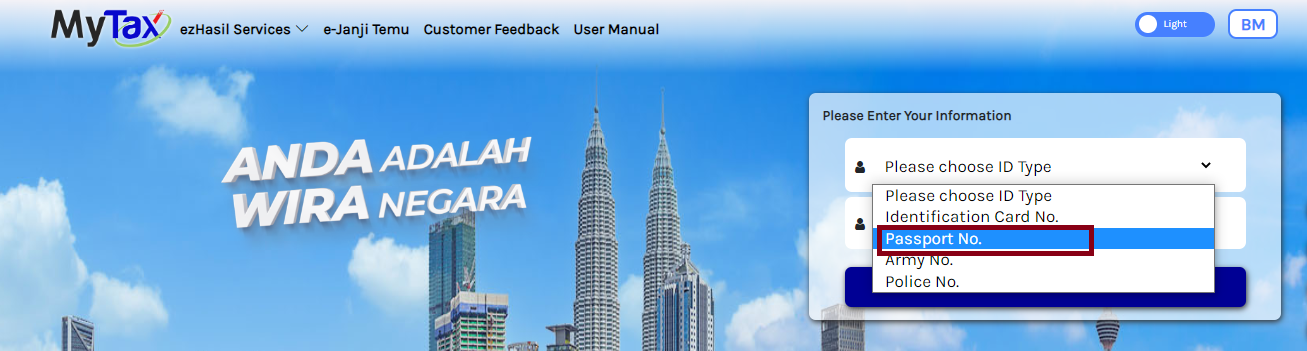

1. Go to the Hasil (Malaysian National Tax Service) website

https://mytax.hasil.gov.my/ (Homepage of Hasil)

2. Log In

Passport number and password must be typed.

Oh! For your information, the important thing here is that foreign workers, who have been paying 30% tax for the first six months, must carry their passports and go to Hasil LHDN office (Malaysian National Tax Service) to get a PIN number. You can log in after receiving the PIN number there.

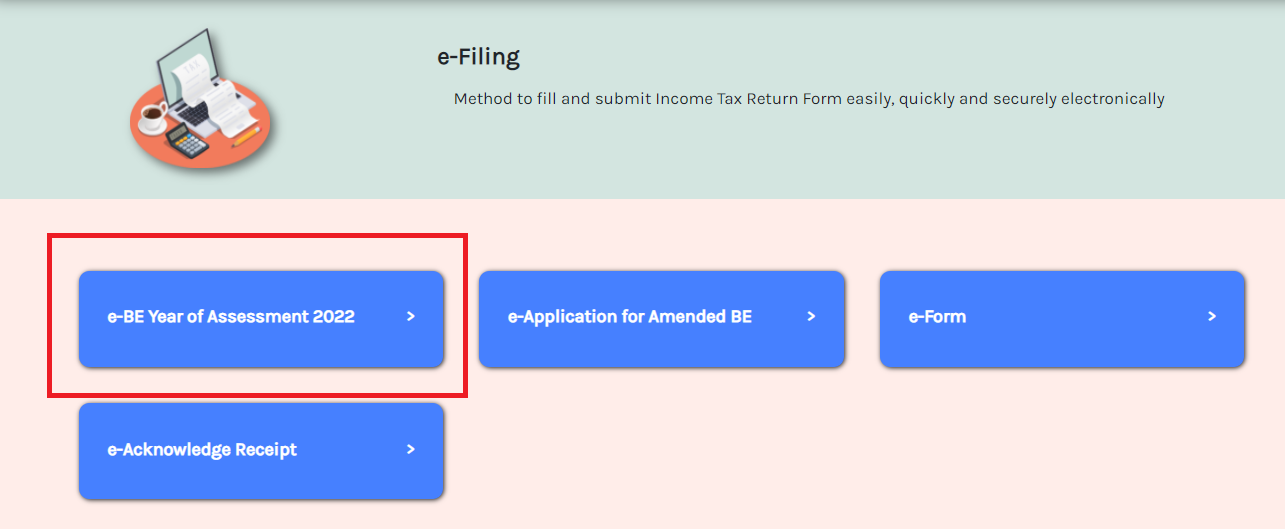

If you log in, you'll see a screen like this.

3. Click the E-Filing

When you click this, you will see the page like this.

Click this page.

Click e-BE 2022

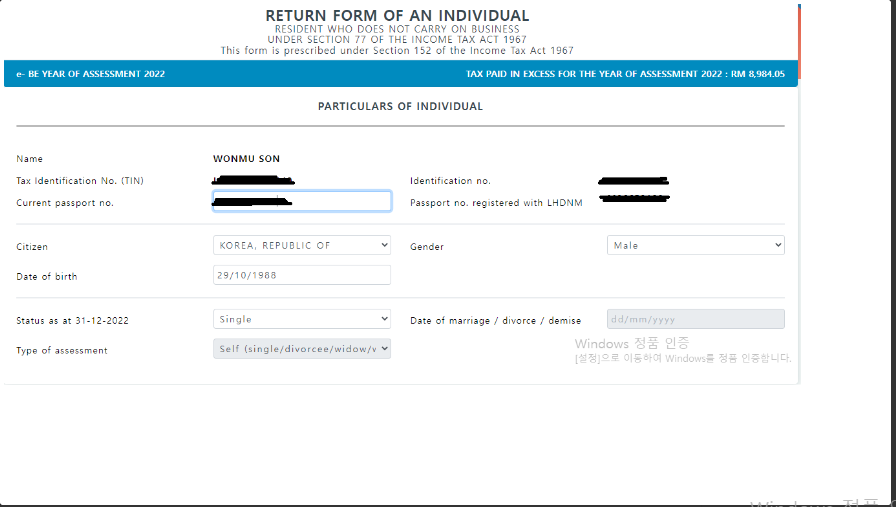

4. Let's report tax in Malaysia.

Type your individual information. (Your Passport No.)

If you are done, go to next stage.

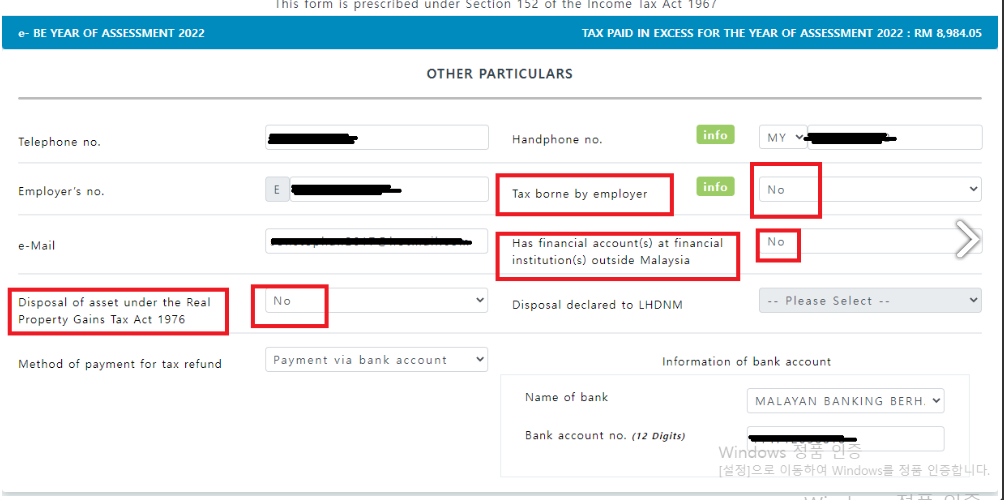

If you bought the real estate in Malaysia such as apartment or condominium in Malaysia, tick yes, and if no, tick no.

For Tax borne by employer means if your company offers EPF (Pension) or something incentive to support tax thingy, you are borned your tax by your employer. But my company (CNX) doesn't support those thingy. So, I ticked "No" If your company provides like EPF thingy, tick "yes."

Has Financial Accounts at financial instituition outside Malaysia means if you have your own company (Establishment), tick yes, if no, tick no :)

And Input your own bank & bank account where you will receive the refund.

Can you follow this instruction well till now?

Let me introduce the next stage.

5. Put your total income referring to your EA form.

Do you have your EA form with you now?

From this page, you need to refer your EA form, which is issued by your employer.

What looks like this is called EA form.

What you are now seeing "Total" in the section of Pension and Others which is located in C section is the total amount of section B -1 (a), (b), (c).

So input your total amount in C section not "B-1-a section" into Statutory income from source of employment in Malaysia section.

Number of Employment is the number of what you are working as. If you moved your company last year, you need to put "2" or put just "1"

And then the MTD(Monthly Tax Deduction) is automatically calculated, so you can just check whether it is correct or not.

Let's move to the next stage.

6. Tax Relief

You will see this page after you are done with reporting your income tax.

This page is for tax relief. If you bought smart phone, smart tablet, or laptop such thingy, you can claim your fee there.

https://www.hasil.gov.my/en/individual/individual-life-cycle/how-to-declare-income/tax-reliefs/

You can refer to this site which category you can claim with. :) There are so many categories you can claim.

6. Check the Tax clearance

If Tax Paid In Excess appears on the tax statement, it means you will get a tax refund, and if Balance of Tax Payable appears, you will have to pay more taxes. I've also been taxed twice more, and I'm finally getting a tax refund this time. 1155.17 ringgit! I'll use it for a good purpose.

Then finally sign and digitally sign, and the process is over.

If you want to get even a little tax back, EPF for about a year or private insurance is okay, and if you travel here and stay at a hotel, about 1,000 ringgit is included in the deduction, so if you want to get a little tax refund, I recommend you do so.

Then thank you for reading this long post and have an energetic day today~~ :)

Best Regards

Stephen

'말레이시아 생활' 카테고리의 다른 글

| 말레이시아의 대실앱 (Feat. Flow 광고아님) (0) | 2023.04.07 |

|---|---|

| 링깃에 대한 모든 것을 알려드리겠습니다. (Feat. 적정 매입가와 매도가) (0) | 2023.04.03 |

| 말레이시아 뉴스 ) 태국 핫 가이 말레이시아 상륙 하지만 십자포화 비난을 받고 있는 중 (1) | 2023.03.29 |

| 말레이시아 일상 ) 오늘부터 "섹스"와 "아침 & 점심"이 불가한 기간 (Feat. 라마단 & 하리라야) (1) | 2023.03.22 |

| [말레이시아 맛집- KL Mid Valley City] Tonkatsu By Ma Maison aka Mid Valley 맛집 (0) | 2023.03.09 |

댓글